Our members’ policy priorities are important to us.

The cleaning industry is a major contributor to the economy, public health, and tax revenues, but still, it faces many legislative and regulatory challenges at the federal, state, and local levels. How issues are addressed, such as how the U.S. might deal with labor shortages, how cleaning chemicals should be regulated, and how goods and services should be taxed, can all impact the industry. Decisions made in Washington D.C. and in the 50 state capitals by lawmakers and regulators can have a huge impact on how the cleaning industry does business.

ISSA’s advocacy efforts are currently focused on the following policy priorities on behalf of its members:

Addressing Labor Shortages and Essential Worker Training

ISSA believes that America needs a strong and robust immigration system that protects the safety of America, and which also promotes our nation’s economic growth.

ISSA members representing the entire supply chain of the cleaning industry are struggling to fill their vacant job positions in part due to the tight labor market and lack of immigration reform. Without necessary reforms our members cannot fulfill the needs of their customers.

ISSA urges Congress and the administration to include the following reforms when the subject of immigration is addressed in Washington, DC:

- Reform should create an immigration system that allows for sufficient immigrants and temporary workers to meet the economic needs of the country, without compromising our nation’s security.

- Reform should create a fair employment eligibility verification system that functions efficiently, effectively, and inexpensively for employers, workers, and government agencies. Any mandate to use e-Verify or another workforce verification system must be phased in a way that does not cause massive workforce disruption.

- Reform should strengthen homeland security by providing for the screening of foreign workers and creating a disincentive for illegal immigration.

- Reform should create a non-seasonal temporary worker program that allows an employer to hire foreign workers when efforts to recruit America workers are unsuccessful. The number of visas available under a new temporary worker program should be based on economic need, rather than an arbitrary cap. Implementing a functional temporary worker program will strengthen border security and improve American productivity.

Training Essential Workers

ISSA supports legislation like the bipartisan, bicameral Freedom to Invest in Tomorrow’s Workforce Act (HR 1477/S 722) that would help essential cleaning professionals get trained and certified. This specific bill would expand qualified expenses under 529 savings plans to include postsecondary training and credentialing, such as licenses and professional certifications, for cleaning workers.

Additional Resources

- Essential Workers for Economic Advancement Act

- The Impact of Immigration Rules on Staffing

- The Legal Immigration and Border Enforcement Reform This Year (LIBERTY) Campaign

- The Essential Worker Immigration Coalition (EWIC) is a broad-based coalition of national businesses and trade associations who are concerned with the shortage of both semi-skilled and unskilled labor.

- Tomorrow’s Workforce Coalition – Advocating for a Stronger Workforce

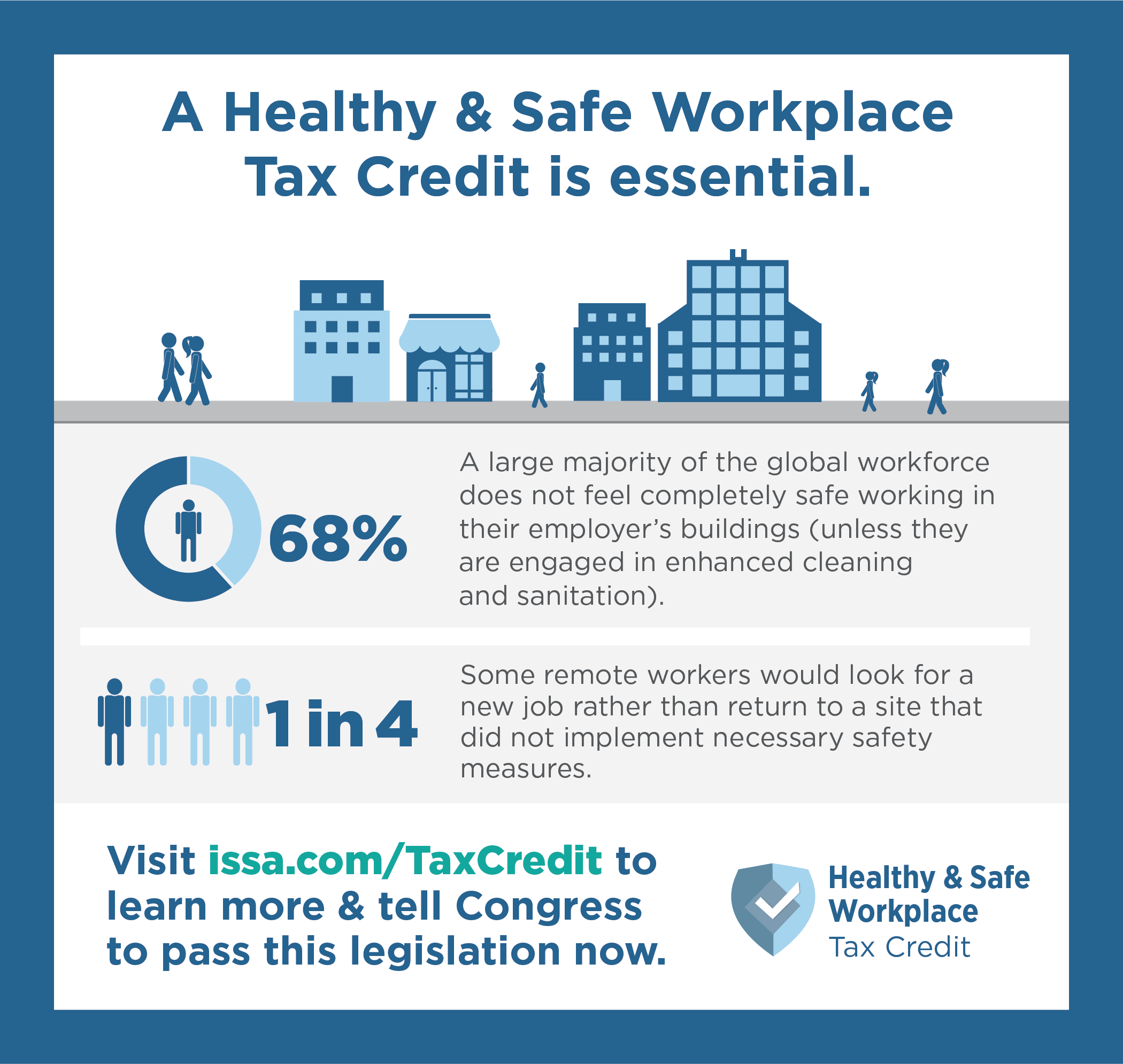

The Importance of A healthy and Safe Workplace Tax Credit

A healthy and safe workplace tax credit is needed to help businesses uphold cleanliness levels, protect employees, and give the public confidence when visiting facilities. According to the National Safety Council, employers have spent an average of US$5,208 per employee on various workplace safety practices since the COVID-19 pandemic began. Businesses and nonprofits already struggling financially should not have to decide between safety and going out of business.

The tax credit has bipartisan and bicameral support, and support from more than 50 trade associations representing a cross section of the economy. It would help businesses cover the cost of:

- Cleaning, disinfecting, and air filtration solutions

- Personal protective equipment (PPE)

- Physical distancing and safety technologies, plexiglass, and other modifications

- Employee training and certification.

Infographic: Why a Healthy and Safe Workplace Tax Credit is Needed

Take Action

Join ISSA in telling Congress to support S. 537, a commonsense proposal to help businesses provide a safe and sanitary environment for their workers and customers. This would give Americans the confidence and peace of mind to safely get back to work and revitalize our economy.

Use These Graphics to Advocate on Social Media. Click on the social card to open in a new tab/window.

Suggested Copy for Your Social Media Post:

- [INSERT YOUR ORGANIZATION NAME] and 50+ organizations support a Healthy & Safe Workplace Tax Credit to help offset the costs of new solutions, technologies, and training to keep employees and customers safe. Visit issa.com/TaxCredit to learn more and urge Congress to pass this legislation.

- A Healthy and Safe Workplace Tax Credit can help businesses cover the cost of cleaning & disinfecting solutions, PPE, physical distancing modifications, and employee training to make these environments safer. Visit issa.com/TaxCredit to urge Congress to pass this tax credit.

- We stand in support of a Healthy & Safe Workplace Tax Credit that would help businesses cover the cost of new cleaning and safety solutions to better protect their workforces and their customers. Visit issa.com/TaxCredit to urge Congress to support this legislation.

Join the Coalition

More than 50 groups across the U.S support a healthy and safe workplace tax credit. If your organization is interested in joining the list of supporters, please contact John Nothdurft, ISSA Director of Government Affairs.

Healthy & Safe Workplace Tax Credit Supporters:

| American Association of Oral and Maxillofacial Surgeons | International Safety Equipment Association |

| American Forest & Paper Association | International WELL Building Institute |

| American Gaming Association | ISSA – The Worldwide Cleaning Industry Association |

| Academy of General Dentistry | NACS |

| American Car Rental Association | NAIOP, the Commercial Real Estate Development Association |

| American Society of Association Executives | National Association of Manufacturers |

| American Society of Interior Designers | National Association of Theatre Owners |

| American Hotel and Lodging Association | National Association of Truckstop Operators |

| Asian American Hotel Owners Association | National Council of Nonprofits |

| Building Owners and Managers Association International | National Grocers Association |

| Building Service Contractors Association International | National Independent Venue Association |

| Dental Trade Alliance | National Office Products Alliance |

| Energy Marketers of America | National Pest Management Association |

| Exhibitor Appointed Contractor Association | National Restaurant Association |

| Exhibitions & Conferences Alliance | National Retail Federation |

| Exhibition Services & Contractors Association | National Safety Council |

| Experiential Designers and Producers Association | National Small Business Association |

| FMI – The Food Industry Association | Natural Products Association |

| Go LIVE Together | North American Meat Institute |

| Household & Commercial Products Association | Office Furniture Dealers Alliance |

| International Facility Management Association | The Payroll Group |

| Independent Bakers Association | Professional Beauty Association |

| Independent Office Products & Furniture Dealers Association | The Real Estate Roundtable |

| Insights Association | Retail Industry Leaders Association |

| International Association of Exhibitions and Events | Small Business & Entrepreneurship Council |

| International Council of Shopping Centers | Society of Independent Show Organizers |

| International Franchise Association | The Sheet Metal and Air Conditioning Contractors National Association |

| International Health, Racquet & Sportsclub Association | Virginia Small Business Partnership |

Taxes

Taxes are the main mechanism governments use to raise revenue in order to fund government revenue or change people’s behavior (for example, the amount they spend on goods or the among they work).

Income taxes, property taxes, inventory taxes, and sales taxes on services are just to name a few of the taxes paid by ISSA members. Cleaning services are often not exempted from these taxes, and labor inefficiencies result upon their implementation as workers choose between trade-offs of working more to earn the same amount of income and working less to avoid it.

Not surprisingly, taxes are a hotly debated topic and policymakers spend a lot of time trying to figure out what amount of taxation is optimal, or whether taxation should occur at all. ISSA will continue to closely monitor and engage on tax proposals and tax reforms that may impact the cleaning industry.

Additional Resources

Tariffs

A tariff is a tax on imported goods. Whether the goods are finished, intermediate, or inputs into the production process, our member companies experience firsthand the negative impact tariffs have on businesses throughout the industry.

Over time, tariffs’ affects will trickle into the entire industry supply chain. In turn, increased costs will occur for commercial and institutional customers such as hospitals, nursing homes, K-12 schools, and food-processing establishments—compromising their ability of many facilities to maintain safe and sanitary conditions. Tariffs also create significant uncertainty for American employees.

Lately, the U.S. has been using tariffs in attempt to change other countries’ behavior. As a member of the Americans for Free Trade coalition, ISSA opposes tariffs and supports comprehensive trade agreements that reduce the impediments for the industry to freely trade with companies in other countries.

Additional Resources

- ISSA Celebrates USMCA Signing

- ISSA Responds to Tariff Increases

- Timeline of the U.S.-China Trade War

To learn more, visit:

Get Involved!

If you are interested in learning more about ISSA’s advocacy efforts, staying updated on policy and regulatory affairs, or becoming more involved in our initiatives, please use the form to contact us. A member of our Advocacy team will reach out to you shortly.